Governance, Risk & Compliance in Corporate Ethics

Case Study: Enron Corporation & Wells Fargo – A Deep Dive into Ethical and Operational Failures

📌 Overview

This research paper explores the systemic governance breakdowns at Enron and Wells Fargo, two companies whose failures shook public trust in corporate integrity. It applies Governance, Risk, and Compliance (GRC) frameworks to analyze why these collapses occurred, what controls failed, and how stronger ethical policies could have averted catastrophe.

While Enron represents financial fraud on a massive scale, Wells Fargo reveals a more modern failure: an ethical culture corrupted by performance pressure. These cases were chosen for their relevance to both regulatory evolution and leadership accountability.

🎯 Objectives

- Demonstrate the real-world impact of flawed corporate governance and risk oversight.

- Compare two landmark failures using a structured GRC lens.

- Highlight how internal culture and tone at the top shape long-term ethics.

- Propose actionable improvements for compliance frameworks and corporate accountability.

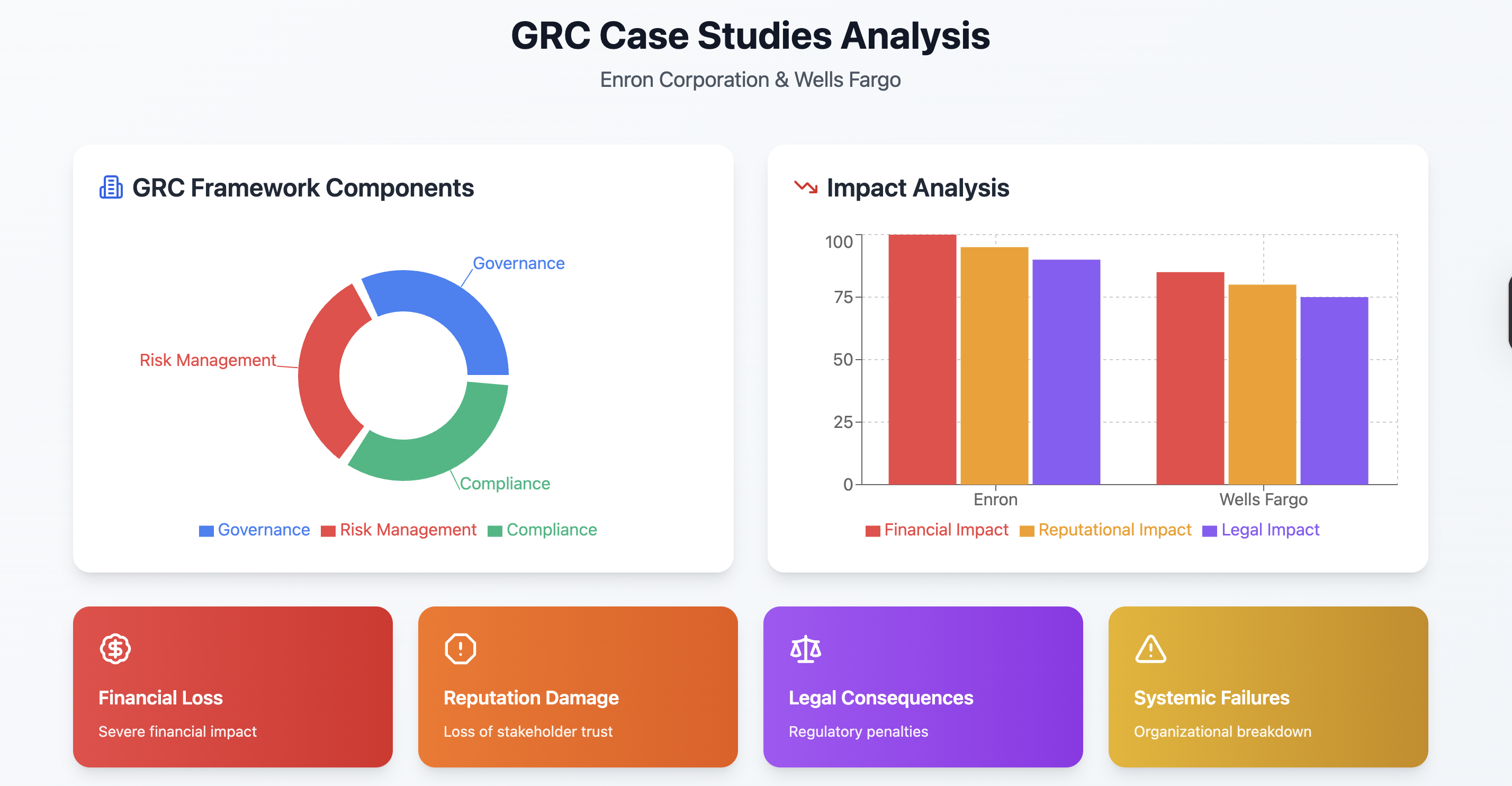

📘 Understanding GRC

- Governance: How decisions are made, monitored, and led at executive and board levels.

- Risk Management: Identifying, assessing, and mitigating internal and external risks.

- Compliance: Ensuring adherence to laws, regulations, and ethical codes of conduct.

GRC is not just a control mechanism — it is the foundation for sustainable, transparent business operations.

🏢 Case Study 1: Enron Corporation

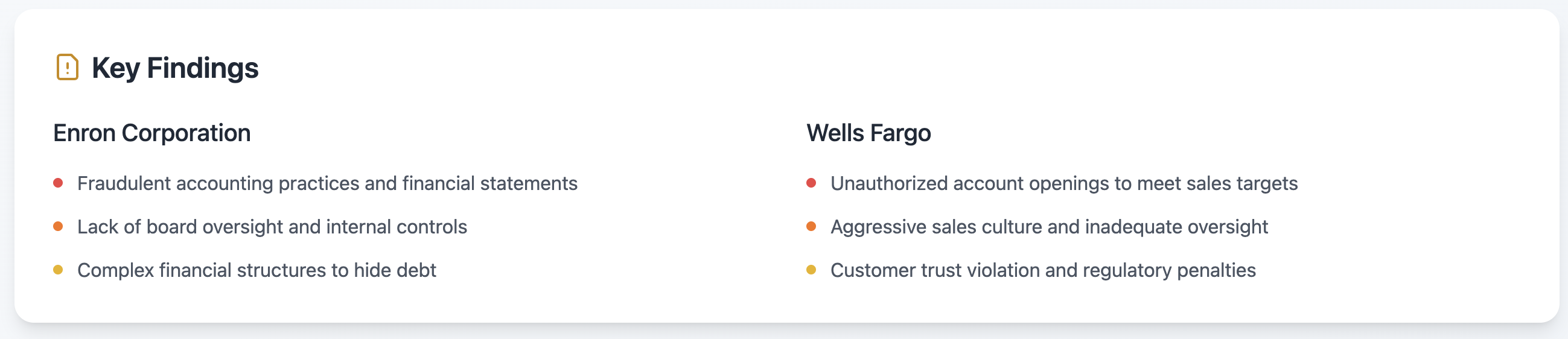

Enron’s fraudulent practices were hidden through shell companies, false accounting entries, and deceptive reporting that artificially inflated stock prices. Its board failed to question financial statements, while executives offloaded stock before collapse.

- Governance Breakdown: Board and audit committee lacked independence and transparency.

- Risk Ignorance: Off-book entities like SPEs were created to hide liabilities.

- Compliance Failure: Enron exploited gaps in GAAP and Sarbanes-Oxley wasn’t in place yet.

The collapse destroyed $74 billion in shareholder value and led to tighter regulatory frameworks like Sarbanes-Oxley Act (SOX).

🏦 Case Study 2: Wells Fargo & Co.

Wells Fargo employees opened over 3.5 million fake customer accounts due to pressure to meet unrealistic sales quotas. The fraud occurred over years, with senior leadership failing to act on early warnings.

- Governance: Leadership emphasized sales at any cost, eroding ethics from the top down.

- Risk: Employees were incentivized to commit fraud, and whistleblowers were ignored.

- Compliance: Violated federal consumer protection laws; regulators fined the company over $3 billion.

Public trust plummeted and the bank’s CEO resigned. Regulatory scrutiny increased across all U.S. banks.

📊 Comparative Analysis

| Dimension | Enron | Wells Fargo |

|---|---|---|

| Failure Type | Accounting Fraud / Misrepresentation | Operational Fraud / Sales Misconduct |

| Root Cause | Greed + lack of regulation | Unethical sales culture |

| Primary Risk | Investor + Financial | Reputational + Regulatory |

| GRC Breakdown | Governance + Compliance | Governance + Culture |

🛡️ Prevention Strategies

- Establish independent and empowered audit committees.

- Implement whistleblower protection and escalation processes.

- Enforce training programs around ethical decision-making and GRC awareness.

- Conduct routine compliance audits tied to executive compensation.

🎓 Relevance to Career & Industry

This paper underscores my interest in ethical system design, risk-aware engineering, and organizational responsibility. It has helped me appreciate not just the tech behind systems — but the ethics and policies that govern them.

Whether in security, DevOps, compliance automation, or leadership, understanding failures like Enron and Wells Fargo helps engineers build safer systems and cultures.